CFA Advocacy Win! Government of Canada extends CEBA loan repayments until the end of 2024

The Government of Canada has announced that recipients of the Canada Emergency Business Account (CEBA) loan will receive an extra year to repay the loans in full. This announcement was as a result of repeated calls from the business community, including the CFA, for the government to provide needed relief to small businesses still recovering from the COVID-19 pandemic.

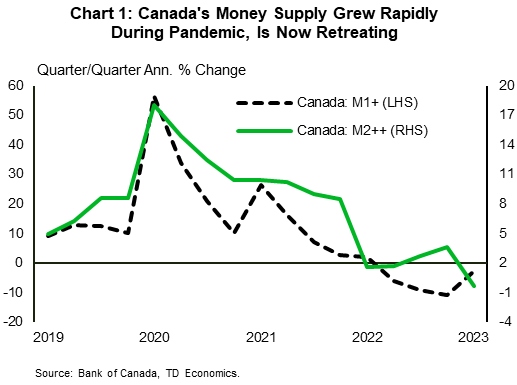

Too Much Money Can Exacerbate Inflation

by TD Economics

The sharp acceleration in money supply and inflation in the aftermath of the pandemic has reignited a debate over the direct role money plays in driving faster price growth. Central banks once paid close attention to money supply. From 1975 to 1982, the Bank of Canada (BoC) directly targeted growth of M1 – a monetary aggregate consisting of currency and bank chequable deposits.

CFA’S ADVOCACY PRIORITIES FOR 2022-2023

- Educating Public Officials About Franchising

- Access to Labour for Franchisors and Franchisees

- Access to Capital

- Common Employer: Adopt the 4 Factor Test

- Ensuring a Fair Playing Field for Franchised Business under Environmental Legislation

Fair Treatment Under Environmental Legislation

Our proposal would allow individuals to withdraw up to $100,000 from their RRSP/RESP accounts to make a down payment on the purchase of a new or existing business, without having to pay tax on the withdrawal.

This proposal would allow individuals who are ready, willing, and able to start a business to unlock some of their retirement savings to purchase a new or existing business.

RELEVANT NEWS

Consumers are spending less, but small businesses can adapt: BDC Top Consumer Trends report

Geopolitical tensions, environmental concerns, rising prices and reduced spending power are motivating Canadians to cut back and entrepreneurs can respond, according to the latest edition of BDC’s 2023 Consumer Trends report.

Unemployment rate steady at 5.5% in August as economy adds 40K jobs: Statistics Canada

“Canada’s job market has been following a sawtooth pattern this year, with a soft report generally followed by a snapback, and this was the month for a minor snapback,” said BMO chief economist Douglas Porter in a client note.

Economic progress report: Target in sight, but we’re not there yet

Speaking a day after we decided to maintain the policy interest rate at 5%, Governor Tiff Macklem explores some key factors behind the decision during a speech on September 7th to the Calgary Chamber of Commerce.

Posthaste: Brace yourself, Canada’s economy is weaker than you think

A recent report by Desjardins argues that the population boom is masking the full extent of Canada’s economic gloom. “Surging population growth — the highest since the 1950s — has provided a tailwind to headline economic activity since mid-2022,” said Randall Bartlett, Desjardins’ senior director of Canadian Economics.

Higher interest rates are ‘painful’ but ‘worth it’: Bank of Canada’s Macklem

“Our two per cent target is now in sight,” Macklem said. “But we are not there yet and we are concerned progress has slowed. Monetary policy still has work to do to restore price stability for Canadians, and we are committed to staying the course.”

CFA ADVOCACY ACCOMPLISHMENTS

The CFA is dedicated to guaranteeing that policymakers nationwide recognize the significant role played by the franchise business model in Canada’s economy and its impact on the livelihoods of nearly two million Canadians employed in franchising.

Learn more about our recent advocacy accomplishments here:

2023 | 2022 | 2021 | 2020 | 2019

Thank You to Our Advocacy Champions

THE CFA NEEDS YOUR SUPPORT!

Be active, be engaged, and get involved with the CFA’s advocacy work to help protect the franchise business model.

We need your donation to help support the work we’re doing to protect, promote, and advance the franchise industry in Canada. By supporting CFA’s advocacy with a financial donation, you can help augment and strengthen our advocacy initiatives. Learn more about our initiatives here.