Ontario Minister of Municipal Affairs and Housing resigns, triggering a small Cabinet Shuffle

by Temple Scott Associates

After days of unrest and denials, the Premier has accepted the resignation of Municipal Affairs and Housing Minister, Steve Clark.

Clark has been caught up in discussions of “insider trading” between his former Chief of Staff, Ryan Amato and Developers over land removed from the greenbelt for future housing developments. Amato apparently acted alone to determine the lands that were removed, not revealing the discussions or determinations until Cabinet where it was apparently blindly supported. Amato resigned last week.

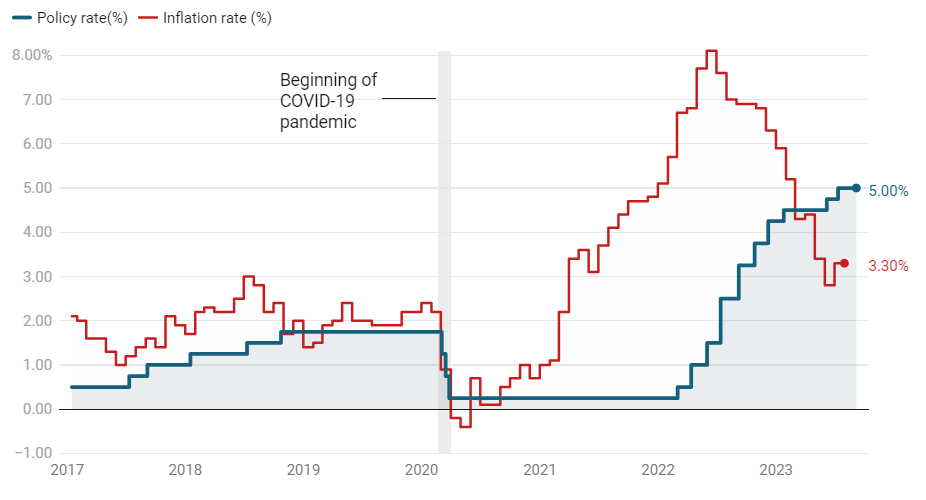

Bank of Canada’s overnight interest rate vs. inflation rate (%)

Current overnight rate is 5.0% as of Sept. 6, 2023. July 2023 year-over-year inflation is 3.3%

Chart: CTVNews.ca | Source: Bank of Canada and Statistics Canada | Created with Datawrapper

Citing the easing of ‘excess demand,’ Bank of Canada reveals its latest decision on the key interest rate

The Bank of Canada decided to hold its key interest rate steady on Wednesday amid mounting evidence the economy is slowing, but the central bank isn’t declaring victory yet as it remains cautious to not fuel speculation about rate cuts.

CFA’S ADVOCACY PRIORITIES FOR 2022-2023

- Educating Public Officials About Franchising

- Access to Labour for Franchisors and Franchisees

- Access to Capital

- Common Employer: Adopt the 4 Factor Test

- Ensuring a Fair Playing Field for Franchised Business under Environmental Legislation

Common Employer: Adopt the Four Factor Test

There needs to be clarity in employment law that allows the franchisor to protect their intellectual property and maintain standards across the system, without the risk of a labour board deeming such actions de facto control, which would result in a common employer declaration.

RELEVANT NEWS

Another drop in job vacancies, another sign the labour market is cooling

In June, the number of job vacancies in Canada edged down by 1.2 per cent to 753,400, having peaked in May, 2022, at more than one million, according to Statistics Canada. That’s the lowest level in more than two years.

David Dodge: Canada ‘not going back’ to pre-pandemic interest rates

Dodge said he thinks it will remain above levels seen in previous decades. He predicted rates will hover at around 3.5 per cent.

“We’re not going back to the (around) two per cent interest rate at the Bank of Canada that we enjoyed in the 10 years leading up to COVID-19,” he said.

Rising business bankruptcies haven’t rattled markets yet. Give it time

In the year up to the end of July, more than 400 U.S. corporations filed for bankruptcy – more than the total for all of 2022, S&P Global Market Intelligence reported earlier this month.

In Canada, the number of business insolvencies rose by 37 per cent in the second quarter compared with the prior year, according to the Office of the Superintendent of Bankruptcy.

Economists see Bank of Canada holding on rates after surprise GDP contraction

The Canadian economy appeared to stall in the second quarter as investment in housing continued to fall, led by drop in new construction. The economy contracted at an annualized rate of 0.2 per cent in the second quarter, Statistics Canada reported, far weaker than forecasters had expected.

Posthaste: Bank of Canada’s 4 inflation ‘pillars’ no longer flashing red supplying interest rate breathing room, analyst

In its Sept. 6 decision to hold rates at five per cent, the central bank warned further hikes depended on “excess demand, inflation expectations, wage growth and corporate pricing power.” Zhao-Murray broke down each of the measures to make the case that the Bank of Canada has achieved its goal of slowing the economy and inflation with its previous 10 rate increases.

CFA ADVOCACY ACCOMPLISHMENTS

The CFA is dedicated to guaranteeing that policymakers nationwide recognize the significant role played by the franchise business model in Canada’s economy and its impact on the livelihoods of nearly two million Canadians employed in franchising.

Learn more about our recent advocacy accomplishments here:

2023 | 2022 | 2021 | 2020 | 2019

Thank You to Our Advocacy Champions

THE CFA NEEDS YOUR SUPPORT!

Be active, be engaged, and get involved with the CFA’s advocacy work to help protect the franchise business model.

We need your donation to help support the work we’re doing to protect, promote, and advance the franchise industry in Canada. By supporting CFA’s advocacy with a financial donation, you can help augment and strengthen our advocacy initiatives. Learn more about our initiatives here.