December 21, 2023

Bank of Canada holds rates, wants more progress on inflation

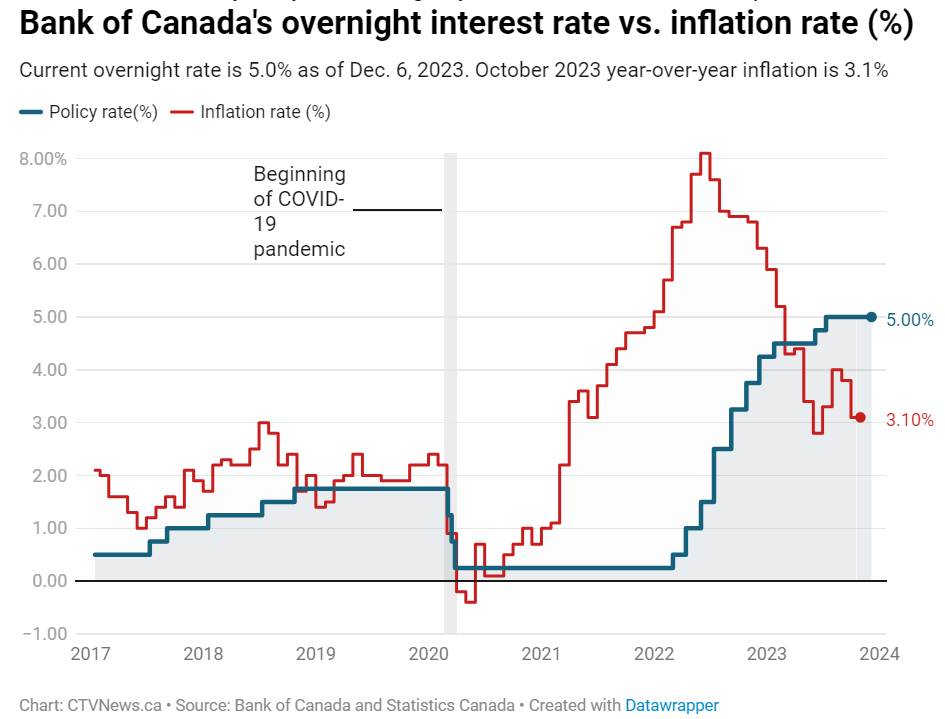

The Bank of Canada held interest rates steady for a third consecutive meeting, acknowledging a stalled economy while keeping the door open to further hikes as officials watch for more progress on slowing inflation.

RELEVANT NEWS

Bank of Canada increasingly believes interest rates are high enough, deliberations show

There’s a greater likelihood monetary policy is “sufficiently restrictive” to bring inflation back to the two per cent target, members of the central bank’s six-person governing council agreed when they made their most recent rate decision.

Future of innovation funding agency in doubt as Ottawa delays implementation until potentially after election

The delay would potentially take the launch of the CIC to after the next federal election, which is slated to happen in October, 2025, meaning it might not materialize at all if there is a change in government.

Tiff Macklem sees Bank of Canada cutting interest rates in 2024

Policymakers need to see “not one or two months” but “a number of months” of deceleration in underlying inflation before considering cutting rates, Macklem said.

Job vacancies decrease for the fifth consecutive quarter, says StatCan

StatCan says in the third quarter of 2023, there were 69,900 fewer job vacancies for a total of 706,100 job openings. This is a sharp decline from the second quarter of 2022, which had a peak of 990,900 vacant jobs.

Bank of Canada’s Macklem talks down interest rate cuts, but says 2% inflation ‘now in sight’

Macklem made the remarks while delivering his end-of-year speech before the Canadian Club Toronto on Friday, two days after United States Federal Reserve chair Jerome Powell poured fuel on a stock market rally by suggesting that rates were at or close to their peak.

How economists and market bets for BoC rate cuts are reacting to Canada’s inflation data

Canada’s annual inflation rate came in hotter than expected in November, at 3.1% versus expectations for 2.9%, prompting money markets to modestly ease back their bets on interest rate cuts early next year. Here’s how economists and market strategists are reacting to the data.

CFA’S ADVOCACY PRIORITIES FOR 2022-2023

- Access to Labour for Franchisors and Franchisees

- Access to Capital

- Common Employer: Adopt the 4 Factor Test

- Burdens of Small Business:

- Ensuring a Fair Playing Field for Franchised Business under Environmental Legislation

- Educating Public Officials About Franchising

Burdens of Small Business: Minimum Wage

The CFA seeks to ensure increases are predictable and phased in over a reasonable amount of time. Significant and unpredictable increases in the minimum wage can have a dramatic impact on our members and their businesses, potentially resulting in hiring freezes, price increases, and reduction of employee hours.

CFA ADVOCACY ACCOMPLISHMENTS

The CFA is dedicated to guaranteeing that policymakers nationwide recognize the significant role played by the franchise business model in Canada’s economy and its impact on the livelihoods of nearly two million Canadians employed in franchising.

Learn more about our recent advocacy accomplishments here:

2023 | 2022 | 2021 | 2020 | 2019

THE CFA NEEDS YOUR SUPPORT!

Be active, be engaged, and get involved with the CFA’s advocacy work to help protect the franchise business model.

We need your donation to help support the work we’re doing to protect, promote, and advance the franchise industry in Canada. By supporting CFA’s advocacy with a financial donation, you can help augment and strengthen our advocacy initiatives. Learn more about our initiatives here.

Thank You to Our Advocacy Champions