January 18, 2024

CEBA Loan Repayment — Deadline Today

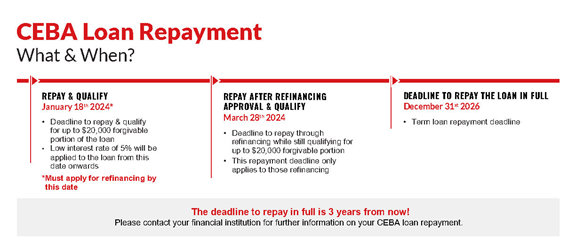

Today (January 18, 2024) is the deadline to repay your Canada Emergency Business Account (CEBA) loan in order to qualify for the up to 33% in loan forgiveness. For those who have applied for refinancing through your preferred financial institution, you have until March 28, 2024 to receive approvals in order to qualify for the partial loan forgiveness.

For those who have not made arrangements to repay the CEBA loans by the end of today, your outstanding balance will convert into a term loan, which is due by December 31, 2026. The Canadian Franchise Association (CFA) has worked tirelessly to advocate on behalf of its members to ensure that they had access to the necessary support required to survive the pandemic. In 2021, understanding the lingering affects of the pandemic and the increased pressure caused by inflation, interest rates, and the cost of borrowing, the CFA was the first industry association to lobby for an extension to the original CEBA loan program. Further, the CFA continued lobbying the federal government well into this fall, until it became clear that a further extension would not be granted. The CFA then focused on developing resources for its members to ensure they had the information needed to make the right decision for their businesses in the required timeframe.

RELEVANT NEWS

Prospect of Bank of Canada rate cuts is boosting Canadians’ views on the economy

The December edition of the Maru Household Outlook Index found that almost 40 per cent of Canadians believe the economy will improve over the next two months — that’s up from 37 per cent in November and 33 per cent in October.

2024 in charts: Experts predict what’s to come for housing, jobs, wages, interest rates and more

Economists, academics, investors and business leaders pick a chart that highlights an issue that will be important to watch in 2024.

Inflation rises to 3.4% in December, complicating path for Bank of Canada

Statistics Canada released its consumer price index report Tuesday, showing inflation ticked up from 3.1 per cent in November, largely because of a sharper decline in gasoline prices a year ago compared with last month.

Canada needs immigration reform to escape ‘population trap,’ economists say

In the report published Monday, economists Stéfane Marion and Alexandra Ducharme say they agree immigration is good for the gross domestic policy (GDP), “but all good things have their limits.”

Bank of Canada Surveys Show Firms Worried About Weak Economy

Firms see “less favorable business conditions,” including slowing demand and renewed competitive pressures, which are “moderating” the rise in output prices.

Looming CEBA repayment deadline may take toll on economy, analysts say

The $49-billion in emergency loans that the federal government lent to nearly 900,000 businesses in the early weeks of the COVID-19 pandemic are finally coming due, almost four years later.

Economists expect December inflation ticked up, trend still points to slowdown

Forecasters are expecting December’s rate to come in above November’s 3.1 per cent as gasoline prices fell more significantly a year ago than they did last month.

Analysis-Bank of Canada may trail Fed rate cut as wage growth runs hot

Inflation in Canada is likely to remain a bigger threat than in the United States due to the high growth in Canadian wages and shelter costs, which could see the central bank shifting to interest rate cuts after the Federal Reserve, say analysts.

Posthaste: Bank of Canada has ‘one of the toughest jobs in financial industry this year,’ TD says

TD Bank economists don’t envy the job facing the Bank of Canada, calling it “one of the toughest … within the financial industry this year” as the central bank faces pressure to correctly time the first interest rate cut since its historic hiking cycle peaked in July.

THE CFA NEEDS YOUR SUPPORT!

Be active, be engaged, and get involved with the CFA’s advocacy work to help protect the franchise business model.

We need your donation to help support the work we’re doing to protect, promote, and advance the franchise industry in Canada. By supporting CFA’s advocacy with a financial donation, you can help augment and strengthen our advocacy initiatives. Learn more about our initiatives here.

Thank You to Our Advocacy Champions

CFA’S ADVOCACY PRIORITIES FOR 2022-2023

- Access to Labour for Franchisors and Franchisees

- Access to Capital

- Common Employer: Adopt the 4 Factor Test

- Burdens of Small Business:

- Ensuring a Fair Playing Field for Franchised Business under Environmental Legislation

- Educating Public Officials About Franchising

Educating Public Officials About Franchising

There is a mistaken perception that franchised businesses are not local businesses. While many brands are recognized across the country and across the world, local stores are owned by franchisees that live and work in their communities, from coast to coast to coast.

CFA ADVOCACY ACCOMPLISHMENTS

The CFA is dedicated to guaranteeing that policymakers nationwide recognize the significant role played by the franchise business model in Canada’s economy and its impact on the livelihoods of nearly two million Canadians employed in franchising.

Learn more about our recent advocacy accomplishments here:

2023 | 2022 | 2021 | 2020 | 2019