January 25, 2024

More Than Just a Gig? Bill 48 Will Offer Protections for Gig Workers In British Columbia

On November 30, 2023, British Columbia’s Bill 48 Labour Statutes Amendment Act, 2023 (Bill 48) received royal assent. Bill 48 is not currently in force and will come into effect by regulation of the Lieutenant Governor in Council on a date that is yet to be determined.

Bill 48 will establish minimum employment standard regulations for the estimated 11,000 ride-hailing drivers and 27,000 food-delivery workers in BC, with the aim of bringing fairness and predictability to these types of jobs.

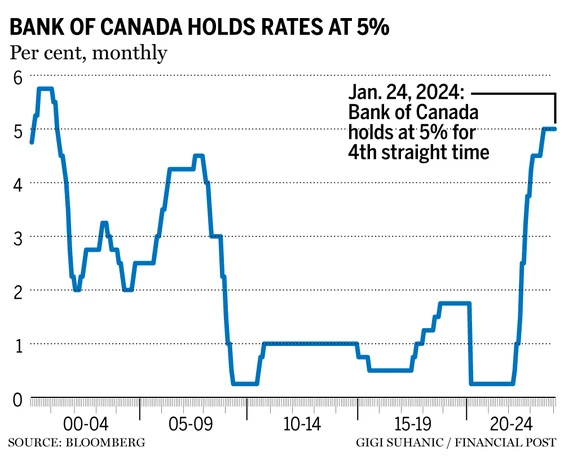

Bank of Canada holds interest rate at 5%, but signals shift in direction

“The Council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation,” the central bank said in a Jan. 24 statement. READ MORE

RELEVANT NEWS

Canada’s reliance on temporary workers reflects innovation gaps, experts say

Canadian companies have lost a step when it comes to innovation, experts say, pointing toward Ottawa having work to do to turn around stagnating business investment and an over-reliance on temporary workers.

What to know about Ottawa’s two-year cap on international student visas, and other measures

Here’s a breakdown of Ottawa’s cap on international students, additional measures and the federal government’s hopes for the changes.

Estimated quarter of businesses missed CEBA repayment deadline, Ottawa says

CEBA was the most widely used pandemic support program for businesses, sending out loans of $40,000 or $60,000 to nearly 900,000 companies in 2020 and 2021. More than $49-billion was extended.

Pandemic aid ‘had to end’ Trudeau says as CEBA deadline hits

Despite consistent small business pressure, Prime Minister Justin Trudeau’s government is defending the decision to maintain the Jan. 18 Canada Emergency Bank Account (CEBA) repayment deadline.

Bank of Canada keeps key interest rate at five per cent, hints it’s now a question of when — not if — it will start cutting

In a press conference, Bank governor Tiff Macklem refused to be pinned down on when rates will come down, acknowledging that economic forecasting is not an exact science.

THE CFA NEEDS YOUR SUPPORT!

Be active, be engaged, and get involved with the CFA’s advocacy work to help protect the franchise business model.

We need your donation to help support the work we’re doing to protect, promote, and advance the franchise industry in Canada. By supporting CFA’s advocacy with a financial donation, you can help augment and strengthen our advocacy initiatives. Learn more about our initiatives here.

Thank You to Our Advocacy Champions

CFA’S ADVOCACY PRIORITIES FOR 2022-2023

- Access to Labour for Franchisors and Franchisees

- Access to Capital

- Common Employer: Adopt the 4 Factor Test

- Burdens of Small Business:

- Ensuring a Fair Playing Field for Franchised Business under Environmental Legislation

- Educating Public Officials About Franchising

Educating Public Officials About Franchising

There is a mistaken perception that franchised businesses are not local businesses. While many brands are recognized across the country and across the world, local stores are owned by franchisees that live and work in their communities, from coast to coast to coast.

CFA ADVOCACY ACCOMPLISHMENTS

The CFA is dedicated to guaranteeing that policymakers nationwide recognize the significant role played by the franchise business model in Canada’s economy and its impact on the livelihoods of nearly two million Canadians employed in franchising.

Learn more about our recent advocacy accomplishments here:

2023 | 2022 | 2021 | 2020 | 2019