November 23, 2023

Learn & Grow Webinar: Navigating CEBA Loan Repayments

On November 20th, the Canadian Franchise Association presented its Learn and Grow Webinar, “Navigating CEBA Loan Repayments,” to inform its members of their options as the interest-free period of the CEBA program comes to an end on January 18, 2024. Thank you to Deirdre Bergin (BMO), Paul daSilva (RBC), and Lalit Jagasia (CIBC) for participating in this important discussion

Thanks to Paul daSilva from RBC, who has created a spreadsheet that outlines your CEBA loan repayment options.

Please note that this spreadsheet is only for informational purposes and does not constitute legal or financial advice. Each franchisor and franchisee should consult their legal and business advisors to determine how this information works within the context of your franchise system and your franchise agreement.

Posthaste: Here’s what it will take for the Bank of Canada to cut rates — and when it might happen

The Bank of Canada could start cutting interest rates before inflation reaches its two per cent target, but only if the labour market co-operates, economists at Desjardins Group say. Click here to learn more.

RELEVANT NEWS

New legislation aims to strengthen and enhance consumer protection

“Our government is committed to a fair and responsible environment in which businesses can operate, and consumers can feel their rights are being respected,” said Finance and Treasury Board Minister Ernie Steeves.

Over 14,000 Canadians sign petition urging for CEBA loan repayment forgiveness

Nearly 900,000 small businesses and non-profits in Canada received a lifeline from CEBA, with a total of $49.2 billion being paid out, according to the government.

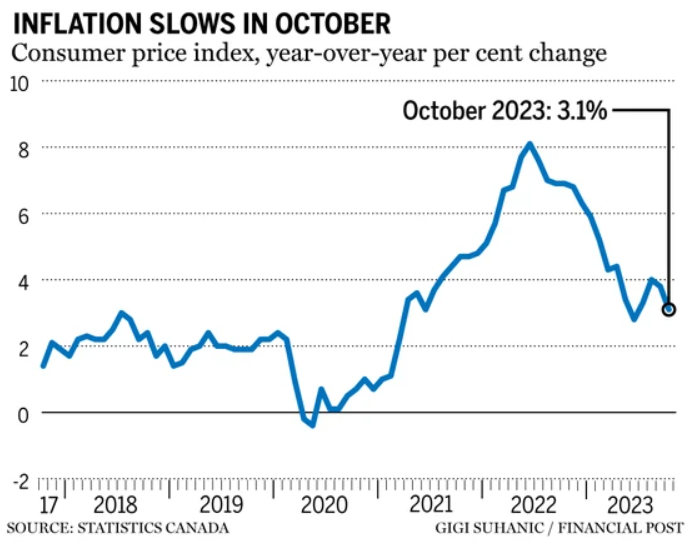

Canada’s inflation rate cools to 3.1% but the cost of living keeps going up

Statistics Canada reported Tuesday that the biggest reason for the deceleration in the cost of living was a drop in the cost of gasoline, which declined by 6.4 per cent during the month of October alone, and is down by 7.8 per cent compared to where prices were a year ago.

Canada needs a lot more immigrants, almost double the current rate in the long run: RBC

Even the current annual immigrant intake of 1.3 per cent of the population is not sufficient to stabilize the age structure, which would require about 2.1 per cent, the RBC Economic Update said.

Posthaste: Interest rates would be lower if governments spent less, says Scotiabank

Scotiabank Global Economics calculates that 200 basis points (two percentage points), of the Bank of Canada’s current 5 per cent interest rate were needed to counteract the effects of government spending and Federal pandemic relief to households.

Six highlights from the fall economic statement as Canadians struggle with affordability issues

The federal government unveiled its 2023 fall economic statement on Tuesday, with promises of new spending to help build affordable homes, support renters and clamp down on Airbnbs.

B.C. proposes minimum pay standards and workers’ compensation for app-based gig workers

The proposed amendments to the Employment Standards Act and the Workers Compensation Act are meant to ensure that workers who take gigs through online platforms are treated like employees, according to a press release from the province.

Bank of Canada’s Macklem says interest rates may be high enough to tame inflation

Bank of Canada Governor Tiff Macklem said borrowing costs may now be “restrictive enough” to get inflation under control, his most explicit comments to date suggesting that interest rates have peaked.

CFA’S ADVOCACY PRIORITIES FOR 2022-2023

- Access to Labour for Franchisors and Franchisees

- Access to Capital

- Common Employer: Adopt the 4 Factor Test

- Burdens of Small Business:

- Ensuring a Fair Playing Field for Franchised Business under Environmental Legislation

- Educating Public Officials About Franchising

Common Employer: Adopt the 4 Factor Test

There needs to be clarity in employment law that allows the franchisor to protect their intellectual property and maintain standards across the system, without the risk of a labour board deeming such actions de facto control, which would result in a common employer declaration.

CFA ADVOCACY ACCOMPLISHMENTS

The CFA is dedicated to guaranteeing that policymakers nationwide recognize the significant role played by the franchise business model in Canada’s economy and its impact on the livelihoods of nearly two million Canadians employed in franchising.

Learn more about our recent advocacy accomplishments here:

2023 | 2022 | 2021 | 2020 | 2019

THE CFA NEEDS YOUR SUPPORT!

Be active, be engaged, and get involved with the CFA’s advocacy work to help protect the franchise business model.

We need your donation to help support the work we’re doing to protect, promote, and advance the franchise industry in Canada. By supporting CFA’s advocacy with a financial donation, you can help augment and strengthen our advocacy initiatives. Learn more about our initiatives here.

Thank You to Our Advocacy Champions