September 21, 2023

Return of Federal Parliament – Fall 2023

by Temple Scott Associates

Federal Parliament resumes sitting this week in a much-changed context from early 2023. Over the summer, the Conservative Party opened a substantial lead in polling, the Prime Minister made a significant Cabinet shuffle, and Canada continued to see sustained inflation.

Canada Emergency Business Account: Government extends repayment and partial loan forgiveness deadlines

Government of Canada News Release

On September 14, 2023, the Prime Minister announced extended deadlines for Canada Emergency Business Account (CEBA) loan repayments, providing an additional year for term loan repayment, and additional flexibilities for loan holders looking to benefit from partial loan forgiveness of up to 33 per cent.

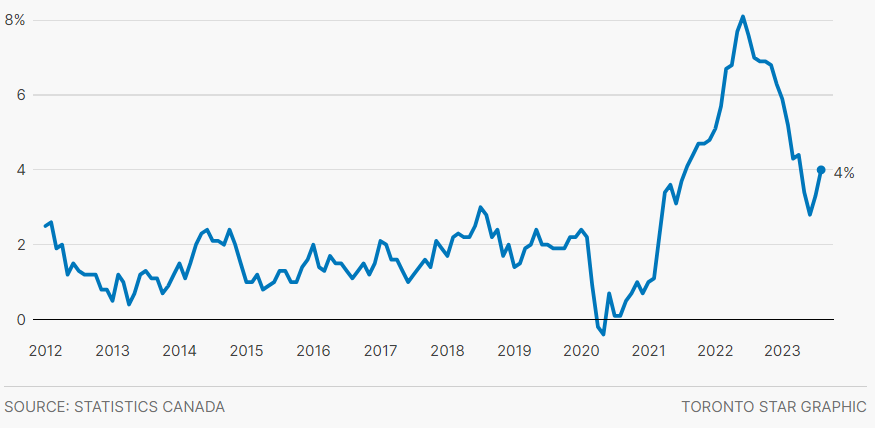

Consumer price index year-over-year percentage change

Current overnight rate is 5.0% as of Sept. 6, 2023. July 2023 year-over-year inflation is 3.3%

Canada’s inflation rate rises to 4% in August on higher gas costs, raising odds of further rate hike

The acceleration was largely driven by a 0.8 per cent year-over-year increase in prices for gasoline in August, Statistics Canada reported Tuesday.

CFA’S ADVOCACY PRIORITIES FOR 2022-2023

- Access to Labour for Franchisors and Franchisees

- Access to Capital

- Common Employer: Adopt the 4 Factor Test

- Burdens of Small Business:

- Ensuring a Fair Playing

- Ensuring a Fair Playing Field for Franchised Business under Environmental Legislation

- Educating Public Officials About Franchising

Educating Public Officials About Franchising

There is a mistaken perception that franchised businesses are not local businesses. While many brands are recognized across the country and across the world, local stores are owned by franchisees that live and work in their communities, from coast to coast to coast.

RELEVANT NEWS

Opinion: Extending CEBA pandemic-loan deadline sadly won’t save many small businesses

Many were forced to resort to their various credit facilities to both stay open and to keep their employees working. This is what misleads so many when it comes to insolvency for small businesses facing the CEBA repayment deadline.

Opinion: Interest rates will stay high, ’cause the stone-cold bond market said so

With inflation moderating and the economy slowing, they reasoned, interest rates will go no higher and will, by next year, start coming back down.

Swings in inflation not ‘unusual,’ but underlying price pressures still high: BoC

“One of the big drivers in inflation this month was coming from energy and gasoline costs,” Bank of Canada deputy governor Sharon Kozicki said. “That’s one of those pieces that can be pretty volatile.”

Statement by Minister of Employment regarding the 2024 EI premium rate

“Today, the Commission has announced that the EI premium rate for 2024 will be $1.66 per $100 of insurable earnings—an increase of 3 cents from the current rate.” said Minister of Employment, Workforce Development and Official Languages Randy Boissonnault.

Big Six banks open to refinancing CEBA loans for small businesses

Ottawa created a new deadline on Thursday: If a business has been in talks with its financial institution to refinance its CEBA loan, it can still have the loan partially forgiven if an agreement is reached by March 28, 2024.

Canada’s inflation rate rises to 4% in August, putting pressure on BoC

Canada’s annual inflation rate accelerated sharply for the second month in a row, raising the odds that the Bank of Canada could deliver at least one more interest rate increase this year despite hitting pause on monetary policy tightening earlier this month.

CFA ADVOCACY ACCOMPLISHMENTS

The CFA is dedicated to guaranteeing that policymakers nationwide recognize the significant role played by the franchise business model in Canada’s economy and its impact on the livelihoods of nearly two million Canadians employed in franchising.

Learn more about our recent advocacy accomplishments here:

2023 | 2022 | 2021 | 2020 | 2019

Thank You to Our Advocacy Champions

THE CFA NEEDS YOUR SUPPORT!

Be active, be engaged, and get involved with the CFA’s advocacy work to help protect the franchise business model.

We need your donation to help support the work we’re doing to protect, promote, and advance the franchise industry in Canada. By supporting CFA’s advocacy with a financial donation, you can help augment and strengthen our advocacy initiatives. Learn more about our initiatives here.